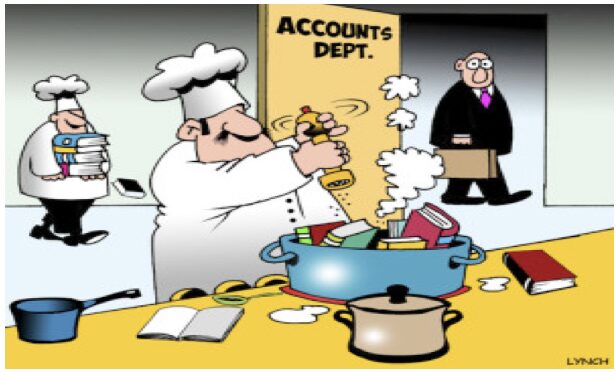

Has anyone been cooking the books?

on August 28, 2019 / by Tom Beswick

As in, the results shown are unlikely to match to the last tax return filed by the company. This is because in a sale situation the business usually gets their accountant to prepare “sale accounts” that add back personal things that might not apply to the new owner.

Ultimately, there is an incentive for vendors to inflate these adjustments as it directly helps them achieve a higher price if profits are adjusted to a higher figure.

This is all totally legitimate, and in many cases is helpful so that you can compare apples to apples. There are often good reasons for any adjustments. But it is key to know what the reasons are, and you need to be aware that there are different approaches to how this is done.

For example, any interest expense is usually added back as the new owner may not have any bank debt.

It makes no sense if a business for sale that has high debt shows low profitability due to high interest costs, when a new owner may not need to borrow to run it.

Other things that are commonly added back can include salaries to working owners, personal vehicles, accounting fees that relate to other group entities, and some asset depreciation.

Taking interest costs out of the profit and loss statement is almost always a correct adjustment to make.

However, an adjustment to say reverse a large bad debt expense might not be – and some judgment may be involved.

Just because it was an unusual event doesn’t mean that’s not a fair reflection of the results of the business and is unlikely to ever happen again.

Understanding the adjustments matters because the “adjusted profit” that they are telling you an owner can earn will often be a key driver in the vendor’s asking price for the business. If the profit has been adjusted too much (i.e. is higher than it should be), then the asking price for the business will be over the odds.

As an example, a vendor may be asking 3 X adjusted profits. If the buyer notices that $5000 in expenses have been separately added back to the asking price, but these are really legitimate ongoing costs that should be part of the adjusted profit figure, then querying them could mean a $15,000 saving in the purchase price.

It is important to remember the IM is a sales document and not gospel. No-one puts them together with the intention to mislead – but rather to present the business in the best possible light.

The document is meant to be reflective of what someone can achieve if they buy the business – not to inflate things.

Make sure you understand what adjustments to the numbers have been made so you do not overpay.

Care is needed and if you aren’t experienced in buying businesses then you need a professional on your side to help.